From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

The election for a seat on the SFERS' Board of Directors is crucially important.

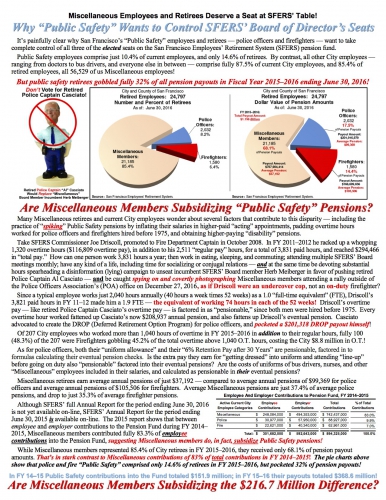

The majority of San Francisco city workers are subsidizing the spectacular benefits for Retired policy officers like SFERS Board member and retired SFFD. The election for a seat on the SFERS' Board of Directors is crucially important.

The election for a seat on the SFERS' Board of Directors is crucially important.

To be very clear, only one seat is up for election to SFERS' Board, but has two candidates: Incumbent Miscellaneous member Herb Meiberger — who is eminently more qualified — and retired Police Captain Al Casciato, whose credentials, education, and experience are woeful in comparison to Meiberger's qualifications to serve!

Curiously, retired Police Captain Al Casciato has elided — failed to mention, or deleted — any mention at all in his two official candidate campaign statements, on his election web site, and his two glossy, "full-bleed" campaign mailers sent in U.S. Mail, that he's a retired cop. Apparently he doesn't want to admit that if he should win, Public Safety (police officers and firefighters) would control all three of the elected seats on the San Francisco Employees' Retirement System's Board of Directors.

His campaign surrogates wrongly claim "we are all one," as if our men and women in blue uniforms will somehow magically stand up and advocate for Miscellaneous members of the Retirement Fund. "Miscellaneous" refers to doctors, nurses, secretaries, accountants, lawyers, bus drivers, custodians, and park gardeners — and everyone else in between — lumped into a single group derogatorily called "Miscellaneous" employees. We are not all one, regardless of our uniforms, or lack of uniforms, and police and fire Public Safety employees are in this to protect their own best interests. We are not "all one"! And police and fire do not really consider Miscellaneous current and retired City employees as their equals.

The election underway includes the likelihood that if Casciato manages to unseat current Miscellaneous Board incumbent Herb Meiberger in the election now being conducted, there's a very strong probability that the Retirement Board will increase the amount of Pension Fund assets allocated to high fees, high-risk, low yield, very illiquid, and opaque (not transparent!) Hedge Fund investments, gambling with your pension fund! Warning: You get who you vote for!

As the attached flyer shows, there is clear and compelling evidence that Miscellaneous employees are subsidizing the pensions of Public Safety personnel. While Miscellaneous member comprised 85.4% of retirees, they received just 68.1% of pension payouts in FY 2015–2016!

There's no getting around this fact. During FY 2014–2015 employee and employer contributions made on behalf of Public Safety officers totaled just $151.9 million in "contributions ‘in’.” But during FY 2015–2016, public safety members totaled $368.6 million in pension payments "out." The data for Public Safety and Miscellaneous member payments during FY 2015–2016 won't be released until early Spring in 2017, but the trend will likely be similar. The data portends contributions on behalf of Miscellaneous members will continued subsidizing Public Safety pensions by $200 million or more, annually.

Consider this: When the then-President of SFERS' Board Al Casciato resigned from SFERS' Board in 2012 and retired from the Police Department, he ended up collecting $75,834 in accumulated vacation and vested sick pay-out, pocketed another $62,046 in "wellness" payout, and deposited into his fortune another $56,096 in accrued compensatory time payout! Quite a haul of a combined $195,976 in lump-sum payouts most Miscellaneous members could only dream of receiving. In addition, Casciato also received another $201,318 in a lump-sum payout from the DROP (Deferred Retirement Option Program) only police officers had been afforded — before the City and Board of Supervisors eventually came to their senses and decided DROP had not ever been "cost neutral," as had been promised when Casciato advocated that the DROP program be adopted.

Notably, each Labor Union "bargains" during contract negotiations for the level and percentages of payouts for such things as various categories of accumulated benefits. It is thought that the Police Officers Union has negotiated at the bargaining table to include in the accumulated benefits payouts a formula factor for the number of years they served in City government. It is thought no other Labor Union has been able to negotiate a "factor of years served" into their payout formulas. Back in 2008 or 2009, IFPTE Local 21 members retired en mass when their accumulated sick pay and wellness benefits were slashed. They retired quickly in order to collect benefits owed them under prior union contracts. Not so with police and fire, who appear to have bargained for, and obtained, better "formulas."

Worse, chief surrogate for candidate Al Casciato is none other than current SFERS' Board member Fire Captain Joe Driscoll, who on December 27 was observed by a dozen or so Miscellaneous members at a rally outside of the POA's headquarters covertly spying on and photographing the protestors — as if Driscoll were an undercover cop, not an on-duty firefighter!

The stakes are high in this election. Please vote for Herb, and forward this e-mail to everyone you know who is allowed to vote in this election and encourage them — in the strongest possible of terms — to vote for Meiberger!

Patrick Monette-Shaw

Retiree

4

To be very clear, only one seat is up for election to SFERS' Board, but has two candidates: Incumbent Miscellaneous member Herb Meiberger — who is eminently more qualified — and retired Police Captain Al Casciato, whose credentials, education, and experience are woeful in comparison to Meiberger's qualifications to serve!

Curiously, retired Police Captain Al Casciato has elided — failed to mention, or deleted — any mention at all in his two official candidate campaign statements, on his election web site, and his two glossy, "full-bleed" campaign mailers sent in U.S. Mail, that he's a retired cop. Apparently he doesn't want to admit that if he should win, Public Safety (police officers and firefighters) would control all three of the elected seats on the San Francisco Employees' Retirement System's Board of Directors.

His campaign surrogates wrongly claim "we are all one," as if our men and women in blue uniforms will somehow magically stand up and advocate for Miscellaneous members of the Retirement Fund. "Miscellaneous" refers to doctors, nurses, secretaries, accountants, lawyers, bus drivers, custodians, and park gardeners — and everyone else in between — lumped into a single group derogatorily called "Miscellaneous" employees. We are not all one, regardless of our uniforms, or lack of uniforms, and police and fire Public Safety employees are in this to protect their own best interests. We are not "all one"! And police and fire do not really consider Miscellaneous current and retired City employees as their equals.

The election underway includes the likelihood that if Casciato manages to unseat current Miscellaneous Board incumbent Herb Meiberger in the election now being conducted, there's a very strong probability that the Retirement Board will increase the amount of Pension Fund assets allocated to high fees, high-risk, low yield, very illiquid, and opaque (not transparent!) Hedge Fund investments, gambling with your pension fund! Warning: You get who you vote for!

As the attached flyer shows, there is clear and compelling evidence that Miscellaneous employees are subsidizing the pensions of Public Safety personnel. While Miscellaneous member comprised 85.4% of retirees, they received just 68.1% of pension payouts in FY 2015–2016!

There's no getting around this fact. During FY 2014–2015 employee and employer contributions made on behalf of Public Safety officers totaled just $151.9 million in "contributions ‘in’.” But during FY 2015–2016, public safety members totaled $368.6 million in pension payments "out." The data for Public Safety and Miscellaneous member payments during FY 2015–2016 won't be released until early Spring in 2017, but the trend will likely be similar. The data portends contributions on behalf of Miscellaneous members will continued subsidizing Public Safety pensions by $200 million or more, annually.

Consider this: When the then-President of SFERS' Board Al Casciato resigned from SFERS' Board in 2012 and retired from the Police Department, he ended up collecting $75,834 in accumulated vacation and vested sick pay-out, pocketed another $62,046 in "wellness" payout, and deposited into his fortune another $56,096 in accrued compensatory time payout! Quite a haul of a combined $195,976 in lump-sum payouts most Miscellaneous members could only dream of receiving. In addition, Casciato also received another $201,318 in a lump-sum payout from the DROP (Deferred Retirement Option Program) only police officers had been afforded — before the City and Board of Supervisors eventually came to their senses and decided DROP had not ever been "cost neutral," as had been promised when Casciato advocated that the DROP program be adopted.

Notably, each Labor Union "bargains" during contract negotiations for the level and percentages of payouts for such things as various categories of accumulated benefits. It is thought that the Police Officers Union has negotiated at the bargaining table to include in the accumulated benefits payouts a formula factor for the number of years they served in City government. It is thought no other Labor Union has been able to negotiate a "factor of years served" into their payout formulas. Back in 2008 or 2009, IFPTE Local 21 members retired en mass when their accumulated sick pay and wellness benefits were slashed. They retired quickly in order to collect benefits owed them under prior union contracts. Not so with police and fire, who appear to have bargained for, and obtained, better "formulas."

Worse, chief surrogate for candidate Al Casciato is none other than current SFERS' Board member Fire Captain Joe Driscoll, who on December 27 was observed by a dozen or so Miscellaneous members at a rally outside of the POA's headquarters covertly spying on and photographing the protestors — as if Driscoll were an undercover cop, not an on-duty firefighter!

The stakes are high in this election. Please vote for Herb, and forward this e-mail to everyone you know who is allowed to vote in this election and encourage them — in the strongest possible of terms — to vote for Meiberger!

Patrick Monette-Shaw

Retiree

4

Add Your Comments

Comments

(Hide Comments)

According to new surveys, the majority of San Francisco city employees or miscellaneous employees are massively subsidizing the pensions of SFPOA cops and firefighters. The SFPOA along with Bob Muscat executive director of the IFPTE Local 21 and the Municipal Executives Association MEA are now spending hundreds of thousands of dollars to kick off the only miscellaneous representative Herb Meiberger and capture control of the pension system so they can turn billions over the funds into highly speculative and secret hedge funds with likely kickbacks to Mayor Ed Lee who backs the scheme. Lee has also appointed hedge fund speculator Wendy Paskin Jordan who has made money personally off the investments of the pension fund of SF city workers. She also has given thousands of dollars to the cops and supports the SFPOA which also has a long racist reactionary history and in this last election cycle gave money to Trump and his campaign in California.

Slamming a Door on Hedge Funds Fair Game "Mr. Meiberger did make public emails from beneficiaries concerned that workers’ savings would be invested in hedge funds. “I abhor talk of ‘gambling’ our previous conservatively investment retirement funds in any hedge fund games,” one beneficiary wrote. “Stop the talk of this now!”

https://www.nytimes.com/2014/09/21/business/slamming-a-door-on-hedge-funds.html?_r=0

By GRETCHEN MORGENSON SEPT. 20, 2014

Are public pension funds over their crush on hedge funds?

Looking for better returns, public pension funds in recent years have been socking away money in those lightly regulated vehicles. Some pension overseers have criticized this trend, but they have been few in number and have often been drowned out by hedge fund proponents. Those overseers’ arguments, however, are sound: Hedge funds, with their high fees, secrecy and recent underperformance, are inappropriate investments for most funds charged with providing retirement and other benefits to former workers.

Last week, those critics received a big boost when the California Public Employees’ Retirement System, or Calpers, said it would divest itself of its entire $4 billion portfolio of hedge funds over the next year.

Citing high costs and complexity associated with its holdings in 24 hedge funds and six so-called funds of funds, Calpers said the investments were “no longer warranted.” Hedge funds typically charge 2 percent of the assets they manage and an additional 20 percent of any profits they generate. Investors in funds-of-funds pay even more: 3 percent and 30 percent.

In its announcement, Calpers said nothing about the performance of the hedge fund investments, but it was probably dismal. As the stock market has roared to new highs, most hedge fund managers have been unable to keep up. According to Preqin Ltd., a research firm, hedge funds have vastly underperformed the Standard & Poor’s 500-stock index over the last one, three and five years. Other indexes show them lagging on a 10-year basis, too. Fund-of-funds performance is even worse.

With $300 billion in assets under management, Calpers’s $4 billion investment in hedge funds is relatively small. But as the nation’s largest pension fund, it is closely watched by its peers.

Frederick E. Rowe Jr., vice chairman of the Employees Retirement System of Texas and general partner at Greenbrier Partners, a money management firm in Dallas, said he hoped Calpers’s move would be a game-changer for pensions. “This is a really critical period in the investment world where pension funds have a chance to demonstrate a little responsibility,” he said. “We should be paying less and getting more for our retirees. Calpers is teeing it up for everybody.”

But the question remains whether other public pension funds, whose managers have committed far more of their portfolios to hedge funds, will follow Calpers’s lead. After all, many of these funds follow the advice of consultants who are paid more for advising pensions when hedge funds are involved.

Among the problems posed by hedge funds, pension experts say, are exorbitant fees and illiquidity. (Many hedge funds have one-year lockups, limiting investors’ ability to get out.) Moreover, they are about as transparent as mud.

“As a trustee, I was not allowed to see the hedge fund contracts,” said Chris Tobe, a former trustee for the Kentucky Retirement Systems, and one of those quiet hedge fund critics in the pension world. “The auditor wasn’t allowed to see the contracts, and the contract review committee for the Legislature was not allowed to look at them, either. Given the contracts are secret, how do you know they are not overcharging you on fees?”

Funds of funds, which are just collections of hedge funds, are especially inappropriate for pensions, according to Edward A. H. Siedle, founder of Benchmark Financial Services and a former lawyer for the Securities and Exchange Commission.

Not only do funds of funds charge additional fees, they often duplicate investments in other hedge fund portfolios.

Mr. Siedle’s firm investigates money management firms for pension funds. His 2006 review of the Shelby County Retirement System in Tennessee found that the fund had 15 percent of its assets in more than 120 hedge funds, “whose identities, securities holdings, trading costs and custodians are unknown.” Substantial duplication of underlying managers was also found.

Hedge funds’ high fees alone, he said, should be a deal-breaker for pensions. “They are a program that pursues wealth dispersion to Wall Street,” he said. “Their objectives could never be seriously considered a thoughtful, disciplined investment program.”

Pensions’ love affair with hedge funds has been an attempt to mimic the enviable performance of the Yale endowment, which invests in such funds.

But pensions are not endowments. At a minimum, pension experts say, pension funds have different cash-flow requirements. They are obligated to make regular payments to retirees. And, unlike many pension funds, an endowment is more likely to have a dedicated. sophisticated staff to monitor investment managers.

Even as Calpers is ditching hedge funds, others in the state want to increase their exposure. One is William J. Coaker Jr., chief investment officer of the San Francisco Employees’ Retirement System, who earlier this year suggested investing 15 percent of its assets in hedge funds, up from zero. The fund has $20 billion in assets, which cover an estimated 92 percent of its obligations — a relatively high level.

Mr. Coaker contended in a recent meeting, records show, that an investment in hedge funds would reduce volatility at the pension and increase its returns. But Herb Meiberger, a board member since 1992, objected, noting the funds’ fees and risks.

The San Francisco pension fund’s records also show that an earlier investment with a hedge fund program involving currencies ended badly. The fund lost $61 million as a result of the program, on which it paid an additional $35 million in fees. It exited last year around the time that FX Concepts, the investment manager in charge of the program, went bankrupt.

Mr. Meiberger declined to comment further on his views. But he did make public emails from beneficiaries concerned that workers’ savings would be invested in hedge funds. “I abhor talk of ‘gambling’ our previous conservatively investment retirement funds in any hedge fund games,” one beneficiary wrote. “Stop the talk of this now!”

It is not clear what the San Francisco pension fund will do. Mr. Coaker did not return a phone call seeking comment.

But whether pension trustees and staff members have the investing acumen to police hedge fund investments should be a concern, said Howard Crane, a former trustee of the Colorado Public Employees’ Retirement Association who is now an independent fiduciary consultant.

“I don’t think most public funds can invest well in hedge funds,” he said. “But I do think there is an enormous amount of money out there. Hence, there is an enormous amount of money to be made — but by the agents, not the principals.”

SFERS William J. Coaker Jr. Chief Investment Officer $507,831.60

http://transparentcalifornia.com/salaries/san-francisco/

William J Coaker Jr Chief Investment Officer $507,831.60

Name Job title Regular pay Overtime pay Other pay Total

benefits Total pay &

benefits

William J Coaker Jr. Chief Investment Officer

San Francisco, 2015 $507,831.60 $0.00 $0.00 $125,891.73 $633,723.33

Jay P Huish Dept Head V

San Francisco, 2015 $277,842.00 $0.00 $0.00 $73,641.82 $351,483.82

Name Job title Regular pay Overtime pay Other pay Total

benefits Total pay &

benefits

http://transparentcalifornia.com/salaries/search/?a=san-francisco&q=joseph+driscoll&y=2015

Joseph D Driscoll Captain, Fire Suppression

San Francisco, 2015 $151,022.94 $65,753.49 $30,670.22 $47,804.51 $295,251.16

Stansbury Brian G $227,622 in 2015

http://transparentcalifornia.com/salaries/search/?a=san-francisco&q=brian+stansbury&y=2015

Name Job title Regular pay Overtime pay Other pay Total

benefits Total pay &

benefits

Brian G Stansbury Sergeant 3 SFPOA member, SFPD Sgt. and SFERS Board Member

San Francisco, 2015 $140,650.82 $39,796.15 $6,505.35 $40,670.15 $227,622.47

https://www.nytimes.com/2014/09/21/business/slamming-a-door-on-hedge-funds.html?_r=0

By GRETCHEN MORGENSON SEPT. 20, 2014

Are public pension funds over their crush on hedge funds?

Looking for better returns, public pension funds in recent years have been socking away money in those lightly regulated vehicles. Some pension overseers have criticized this trend, but they have been few in number and have often been drowned out by hedge fund proponents. Those overseers’ arguments, however, are sound: Hedge funds, with their high fees, secrecy and recent underperformance, are inappropriate investments for most funds charged with providing retirement and other benefits to former workers.

Last week, those critics received a big boost when the California Public Employees’ Retirement System, or Calpers, said it would divest itself of its entire $4 billion portfolio of hedge funds over the next year.

Citing high costs and complexity associated with its holdings in 24 hedge funds and six so-called funds of funds, Calpers said the investments were “no longer warranted.” Hedge funds typically charge 2 percent of the assets they manage and an additional 20 percent of any profits they generate. Investors in funds-of-funds pay even more: 3 percent and 30 percent.

In its announcement, Calpers said nothing about the performance of the hedge fund investments, but it was probably dismal. As the stock market has roared to new highs, most hedge fund managers have been unable to keep up. According to Preqin Ltd., a research firm, hedge funds have vastly underperformed the Standard & Poor’s 500-stock index over the last one, three and five years. Other indexes show them lagging on a 10-year basis, too. Fund-of-funds performance is even worse.

With $300 billion in assets under management, Calpers’s $4 billion investment in hedge funds is relatively small. But as the nation’s largest pension fund, it is closely watched by its peers.

Frederick E. Rowe Jr., vice chairman of the Employees Retirement System of Texas and general partner at Greenbrier Partners, a money management firm in Dallas, said he hoped Calpers’s move would be a game-changer for pensions. “This is a really critical period in the investment world where pension funds have a chance to demonstrate a little responsibility,” he said. “We should be paying less and getting more for our retirees. Calpers is teeing it up for everybody.”

But the question remains whether other public pension funds, whose managers have committed far more of their portfolios to hedge funds, will follow Calpers’s lead. After all, many of these funds follow the advice of consultants who are paid more for advising pensions when hedge funds are involved.

Among the problems posed by hedge funds, pension experts say, are exorbitant fees and illiquidity. (Many hedge funds have one-year lockups, limiting investors’ ability to get out.) Moreover, they are about as transparent as mud.

“As a trustee, I was not allowed to see the hedge fund contracts,” said Chris Tobe, a former trustee for the Kentucky Retirement Systems, and one of those quiet hedge fund critics in the pension world. “The auditor wasn’t allowed to see the contracts, and the contract review committee for the Legislature was not allowed to look at them, either. Given the contracts are secret, how do you know they are not overcharging you on fees?”

Funds of funds, which are just collections of hedge funds, are especially inappropriate for pensions, according to Edward A. H. Siedle, founder of Benchmark Financial Services and a former lawyer for the Securities and Exchange Commission.

Not only do funds of funds charge additional fees, they often duplicate investments in other hedge fund portfolios.

Mr. Siedle’s firm investigates money management firms for pension funds. His 2006 review of the Shelby County Retirement System in Tennessee found that the fund had 15 percent of its assets in more than 120 hedge funds, “whose identities, securities holdings, trading costs and custodians are unknown.” Substantial duplication of underlying managers was also found.

Hedge funds’ high fees alone, he said, should be a deal-breaker for pensions. “They are a program that pursues wealth dispersion to Wall Street,” he said. “Their objectives could never be seriously considered a thoughtful, disciplined investment program.”

Pensions’ love affair with hedge funds has been an attempt to mimic the enviable performance of the Yale endowment, which invests in such funds.

But pensions are not endowments. At a minimum, pension experts say, pension funds have different cash-flow requirements. They are obligated to make regular payments to retirees. And, unlike many pension funds, an endowment is more likely to have a dedicated. sophisticated staff to monitor investment managers.

Even as Calpers is ditching hedge funds, others in the state want to increase their exposure. One is William J. Coaker Jr., chief investment officer of the San Francisco Employees’ Retirement System, who earlier this year suggested investing 15 percent of its assets in hedge funds, up from zero. The fund has $20 billion in assets, which cover an estimated 92 percent of its obligations — a relatively high level.

Mr. Coaker contended in a recent meeting, records show, that an investment in hedge funds would reduce volatility at the pension and increase its returns. But Herb Meiberger, a board member since 1992, objected, noting the funds’ fees and risks.

The San Francisco pension fund’s records also show that an earlier investment with a hedge fund program involving currencies ended badly. The fund lost $61 million as a result of the program, on which it paid an additional $35 million in fees. It exited last year around the time that FX Concepts, the investment manager in charge of the program, went bankrupt.

Mr. Meiberger declined to comment further on his views. But he did make public emails from beneficiaries concerned that workers’ savings would be invested in hedge funds. “I abhor talk of ‘gambling’ our previous conservatively investment retirement funds in any hedge fund games,” one beneficiary wrote. “Stop the talk of this now!”

It is not clear what the San Francisco pension fund will do. Mr. Coaker did not return a phone call seeking comment.

But whether pension trustees and staff members have the investing acumen to police hedge fund investments should be a concern, said Howard Crane, a former trustee of the Colorado Public Employees’ Retirement Association who is now an independent fiduciary consultant.

“I don’t think most public funds can invest well in hedge funds,” he said. “But I do think there is an enormous amount of money out there. Hence, there is an enormous amount of money to be made — but by the agents, not the principals.”

SFERS William J. Coaker Jr. Chief Investment Officer $507,831.60

http://transparentcalifornia.com/salaries/san-francisco/

William J Coaker Jr Chief Investment Officer $507,831.60

Name Job title Regular pay Overtime pay Other pay Total

benefits Total pay &

benefits

William J Coaker Jr. Chief Investment Officer

San Francisco, 2015 $507,831.60 $0.00 $0.00 $125,891.73 $633,723.33

Jay P Huish Dept Head V

San Francisco, 2015 $277,842.00 $0.00 $0.00 $73,641.82 $351,483.82

Name Job title Regular pay Overtime pay Other pay Total

benefits Total pay &

benefits

http://transparentcalifornia.com/salaries/search/?a=san-francisco&q=joseph+driscoll&y=2015

Joseph D Driscoll Captain, Fire Suppression

San Francisco, 2015 $151,022.94 $65,753.49 $30,670.22 $47,804.51 $295,251.16

Stansbury Brian G $227,622 in 2015

http://transparentcalifornia.com/salaries/search/?a=san-francisco&q=brian+stansbury&y=2015

Name Job title Regular pay Overtime pay Other pay Total

benefits Total pay &

benefits

Brian G Stansbury Sergeant 3 SFPOA member, SFPD Sgt. and SFERS Board Member

San Francisco, 2015 $140,650.82 $39,796.15 $6,505.35 $40,670.15 $227,622.47

For more information:

https://www.nytimes.com/2014/09/21/busines...

Re-elect Herb to the San Francisco Employees’ Retirement System Board

https://www.youtube.com/watch?v=uDnFNF8fGNc

Published on Dec 31, 2016

SEIU's Video for Herb Meiberger's Re-Election Campaign

https://www.youtube.com/watch?v=uDnFNF8fGNc

Published on Dec 31, 2016

SEIU's Video for Herb Meiberger's Re-Election Campaign

For more information:

https://www.youtube.com/watch?v=uDnFNF8fGNc

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network